Balance of Payments

- Home

- Statistics

- Economy

- External Sector

- Balance of Payments

Quarterly Balance of Payments, First Quarter 2022

Quarterly Balance of Payments, Fourth Quarter 2021 12 November 2021

Quarterly Balance of Payments, Third Quarter 2021 13 August 2021

Quarterly Balance of Payments, Second Quarter 2021 11 May 2021

Quarterly Balance of Payments, First Quarter 2021 11 February 2021

Quarterly Balance of Payments, Fourth Quarter 2020 13 November 2020

Quarterly Balance of Payments, Third Quarter 2020 Show all release archives

Overview

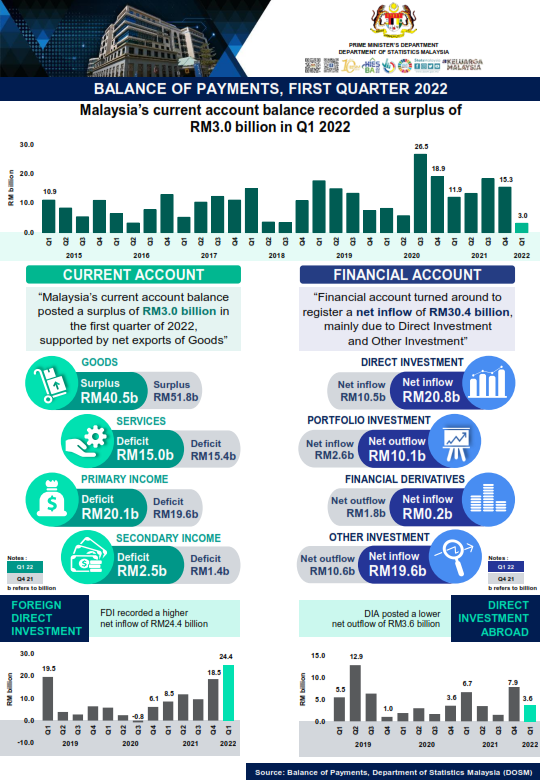

Malaysia’s Current Account Balance records a surplus of RM3.0 billion while FDI remained high at RM24.4 billion in Q12022, mainly driven by

higher settlement of trade credits and equity injection

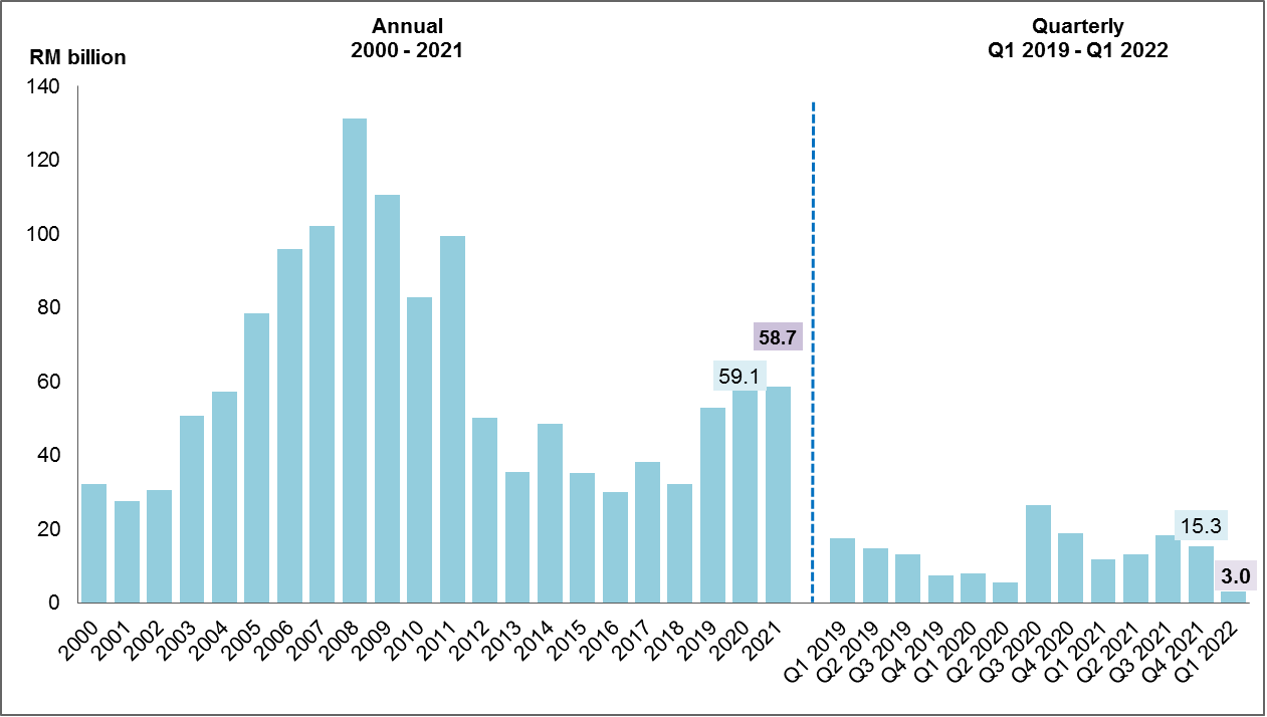

Malaysia’s Current Account Balance (CAB) continued to record a surplus of RM3.0 billion in the first quarter of 2022 compared to RM15.3 billion in the previous quarter. The current account surplus in the first quarter of 2022 was mainly supported by net exports of goods. The Goods account logged net exports of RM40.5 billion compared to RM51.8 billion in the fourth quarter last year. Exports of goods recorded a value of RM268.9 billion as against RM271.3 billion in the previous quarter. The major exports were Electrical & Electronics (E&E), Petroleum and Palm oil based products mainly to China, Singapore and the USA. Meanwhile, imports of goods increased by 4.0 per cent from the previous quarter to reach RM228.4 billion. The higher imports were led by Intermediate and Consumption goods imported mainly from China, Singapore and Taiwan

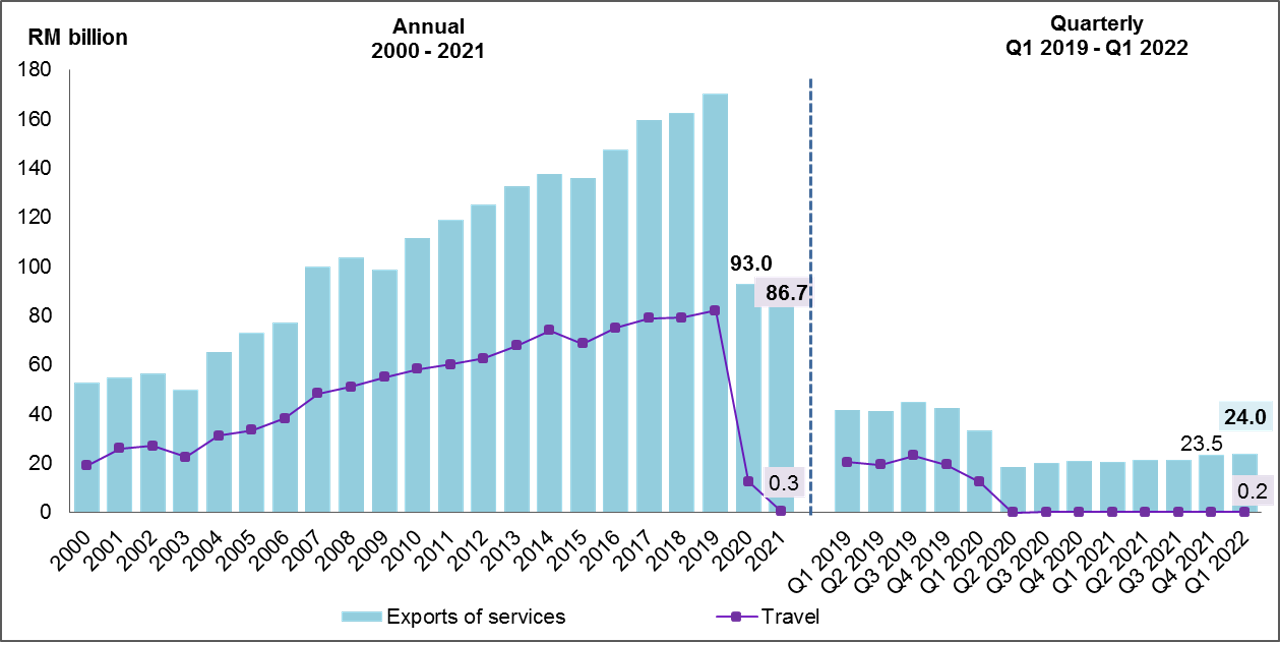

Looking at the performance of services trade, it was observed that exports of Services grew faster than imports. As a result, this account recorded a lower deficit of RM15.0 billion in the first quarter of 2022 compared to a deficit of RM15.4 billion last quarter, supported by higher receipts in Telecommunication, computer and information services and lower payments in Other business services. Based on quarter-on-quarter comparison, exports of Services increased by 2.2 per cent to RM24.0 billion, while Imports rose slightly by 0.2 per cent to RM39.0 billion. The main contributors to services export this quarter were Manufacturing services on physical inputs owned by others, Maintenance and repair; and Telecommunication, computer and information services. Meanwhile, services components that led to the higher imports were Transport, Construction and Travel. However, the deficit in Services account has remained high since the second quarter of 2020, as Travel was hit hard by the pandemic. During January to March 2022, Malaysian residents spent RM4.2 billion abroad, which was higher than the RM0.2 billion spent by foreign travelers in Malaysia, resulting in Travel logged a deficit of RM4.0 billion. In addition, Transport posted a higher deficit of RM9.2 billion owing to the increase in payments for freight activities, in line with the imports of goods.

On the other hand, Primary income account recorded a deficit of RM20.1 billion as compared to RM19.6 billion in the previous quarter. In the first quarter of 2022, foreign companies in Malaysia generated income of RM35.5 billion compared to RM56.9 billion last quarter, mainly through Direct Investment. These companies were largely engaged in Manufacturing and Mining & quarrying sectors with income mostly channeled to the USA, Singapore and the Netherlands. Meanwhile, earnings of Malaysian companies from their activities abroad amounted to RM15.3 billion from RM37.3 billion in the preceding quarter, especially in Direct Investment. Most of these companies were based in Singapore, the USA and Australia, principally in Mining & quarrying sector and Financial activities.

The Financial account recorded a net inflow of RM30.4 billion this quarter compared to RM0.7 billion in the previous quarter. This was mainly contributed by Other Investment which turned around to a net inflow of RM19.6 billion from an outflow of RM10.6 billion in the preceding quarter, due to higher interbank borrowings by financial institution abroad. In addition, net inflows of RM20.8 billion in Direct investment was attributed by higher settlement of exports and loans from abroad which also led to the inflows in Financial account.

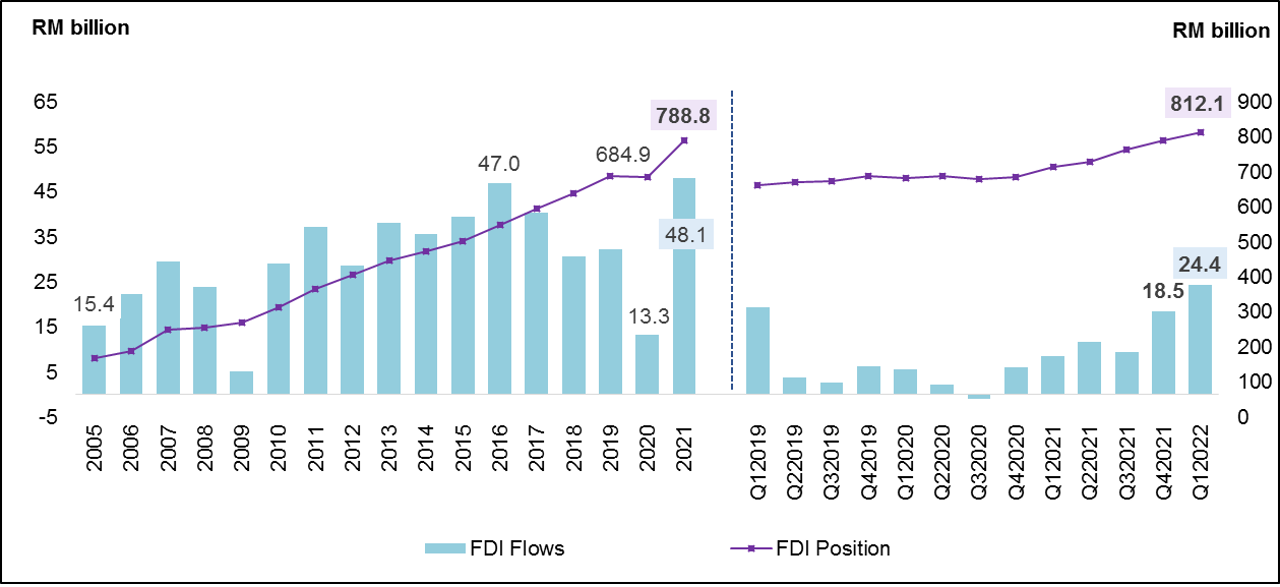

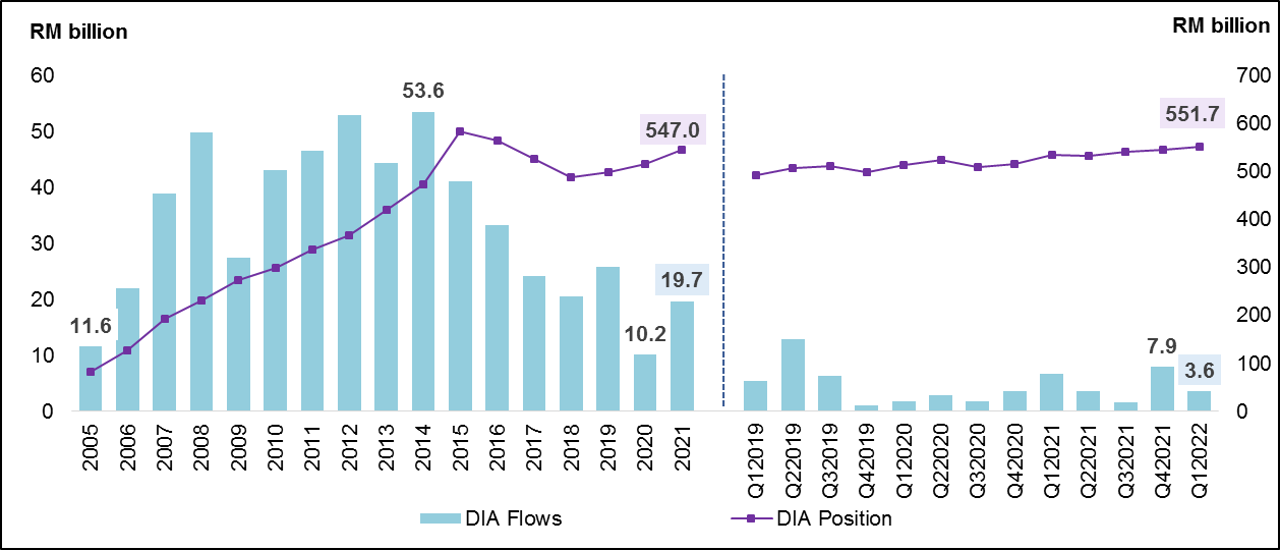

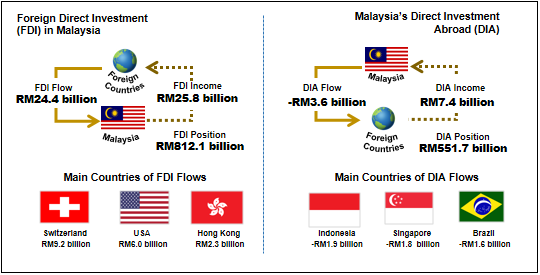

In terms of investment, Foreign Direct Investment (FDI) expanded by RM5.9 billion to record a net inflow of RM24.4 billion for the first quarter. As observed in Direct investment, the inflow was mainly contributed by higher settlement of trade credits by affiliates abroad and injection of equity. Manufacturing sector remains the main attraction for foreign investors in Malaysia, followed by the Services primarily in Financial and Wholesale & retail trade activities. The main sources of FDI came from Switzerland, the USA and Hong Kong. In the meantime, Direct Investment Abroad (DIA) recorded a lower net outflow of RM3.6 billion compared to RM7.9 billion in the preceding quarter, which was due to higher inflow in debt instruments. The major contributors to the outflows were Services, particularly in Financial activities, followed by Manufacturing and Agriculture sectors. The top three DIA destinations were Indonesia, Singapore and Brazil.

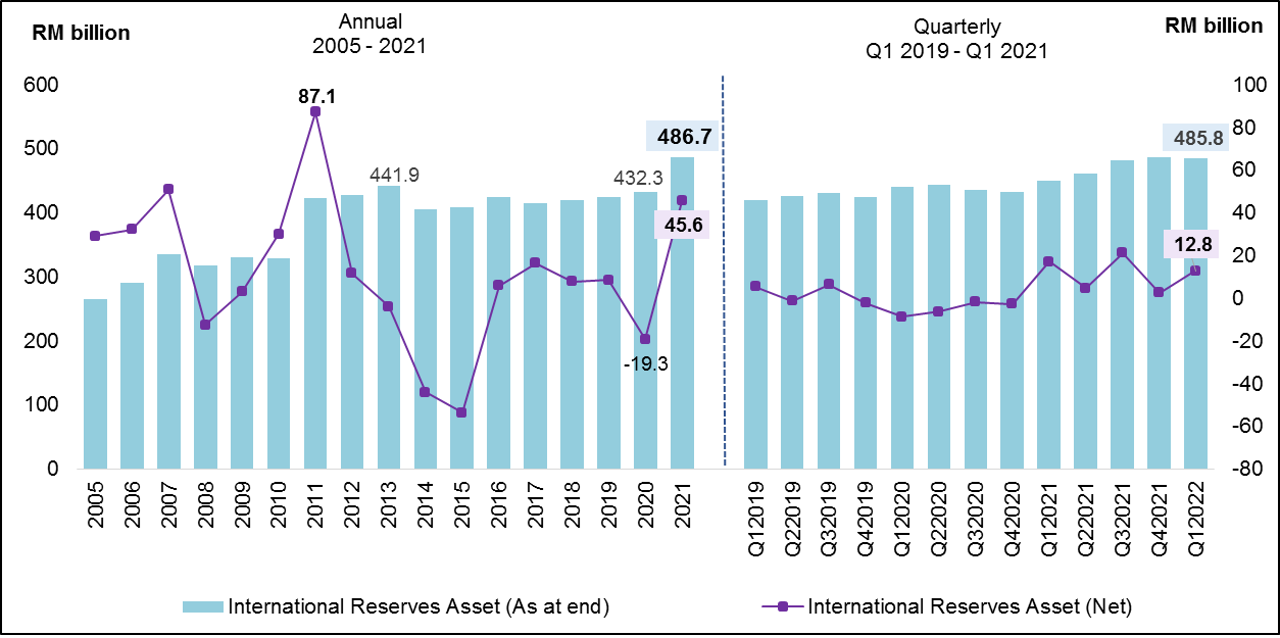

As at the end of the first quarter 2022, FDI position recorded RM812.1 billion while DIA position was RM551.7 billion. Malaysia’s International Investment Position (IIP) recorded a lower net asset position of RM47.3 billion as compared to RM84.9 billion in the previous quarter. The international reserves stood at RM485.8 billion compared to RM486.8 billion in the final quarter of preceding year.

Moving forward, the economy will likely perform better than last year in the coming months after the transition to the endemic phase of COVID-19. With the reopening of the nation’s borders starting from 1 April 2022 to travelers from all countries, it is expected to boost the Travel component and subsequently will revive the Services sector. This is also anticipated to have a direct impact on the Transport, especially in the form of higher receipts from air passengers.

The full publication of Quarterly Balance of Payments, First Quarter 2022 can be downloaded through eStatistik portal.

Chart 1: Current Account Balance, 1985 – 2021 and Q1 2019 – Q1 2022

Chart 2: Exports of Services, 1985 – 2021 and Q1 2019 – Q1 2022

Chart 3: Foreign Direct Investment (FDI) in Malaysia Flows and Position, 2005 – 2021 and Q1 2019 – Q1 2022

Chart 4: Direct Investment Abroad (DIA) Flows and Position, 2005 – 2020 and Q1 2019 – Q1 2022

Exhibit 1: Direct Investment, Q1 2022

Chart 5: International Reserve Assets, 2005 – 2021 and Q1 2019 – Q1 2022

Download: Summary Table of Balance of Payments, Q1 2022 ![]()

Released By:

THE OFFICE OF CHIEF STATISTICIAN MALAYSIA

DEPARTMENT OF STATISTICS, MALAYSIA

13 May 2022

Contact person:

Mohd Yusrizal Ab Razak

Public Relation Officer

Strategic Communication and International Division

Department of Statistics, Malaysia

Tel : +603-8885 7942

Fax : +603-8888 9248

E-mail : yusrizal.razak[at]dosm.gov.my

Subscribe

Newsletter

Subscribe to our newsletter and stay updated

For interviews, press statement and clarification to the media, contact:

Baharudin Mohamad

Public Relation Officer

Email: baharudin[at]dosm.gov.my

Phone: 03 8090 4681

Not found what you looking for? Request data from us, through

Go to eStatistik

Email: data[at]dosm.gov.my

Phone: 03 8885 7128 (data request)