Balance of Payments

- Home

- Statistics

- Economy

- External Sector

- Balance of Payments

Quarterly Balance of Payments, Second Quarter 2021

Quarterly Balance of Payments, First Quarter 2021 11 February 2021

Quarterly Balance of Payments, Fourth Quarter 2020 13 November 2020

Quarterly Balance of Payments, Third Quarter 2020 14 August 2020

Quarterly Balance of Payments, Second Quarter 2020 13 May 2020

Quarterly Balance of Payments, First Quarter 2020 12 February 2020

Quarterly Balance of Payments, Fourth Quarter 2019 Show all release archives

Overview

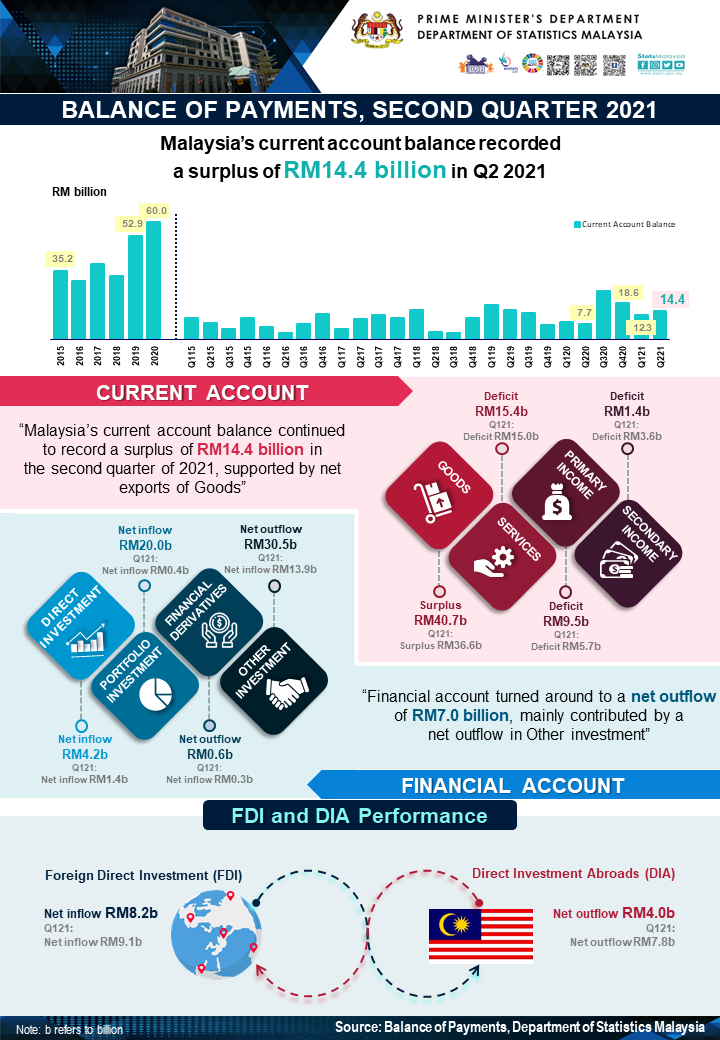

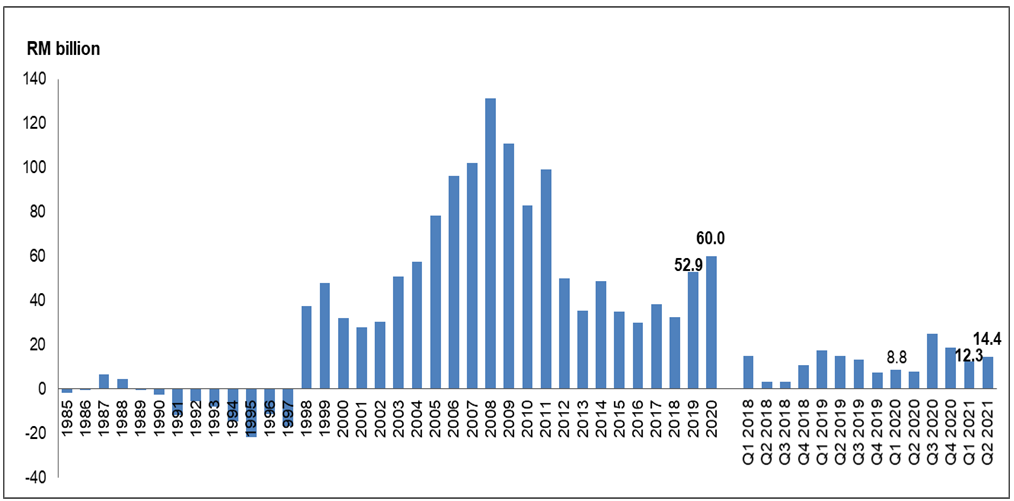

Malaysia’s Current Account surplus soared 17.2 per cent to RM14.4 billion in Q2 2021, steered by better performance in merchandise trade amid a wider deficit in Services

Malaysia’s Current Account Balance (CAB) posted a surplus of RM14.4 billion in the second quarter of 2021, soared 17.2 per cent from RM12.3 billion in the previous quarter. The widening current account surplus was primarily driven by the favourable performance in goods even though the services deficit continued to grow since the second quarter of 2020 amid the COVID-19 outbreak. In this quarter, Goods account increased by 11.1 per cent to record a higher surplus of RM40.7 billion as compared to RM36.6 billion in the preceding quarter. The substantial performance was steered by the higher exports of goods at RM244.0 billion, an increase of RM18.5 billion from last quarter. The main exports were Electrical & electronics (E&E), Petroleum and Rubber-based products; principally to China, Singapore and the United States of America. Imports of goods also showed a similar upward trend which increased by RM14.5 billion to record RM203.4 billion as against the preceding quarter. The main imports were sourced from China, Singapore and Japan whereby the increase in imports was mainly contributed by intermediate goods.

The current account surplus in the second quarter of 2021 was also backed by the lower deficit in Secondary income. Secondary income contracted to RM1.4 billion as compared to RM3.6 billion in the preceding quarter. This was due to higher receipts from abroad while payments decreased as lesser money sent abroad following the decline in number of foreign workers.

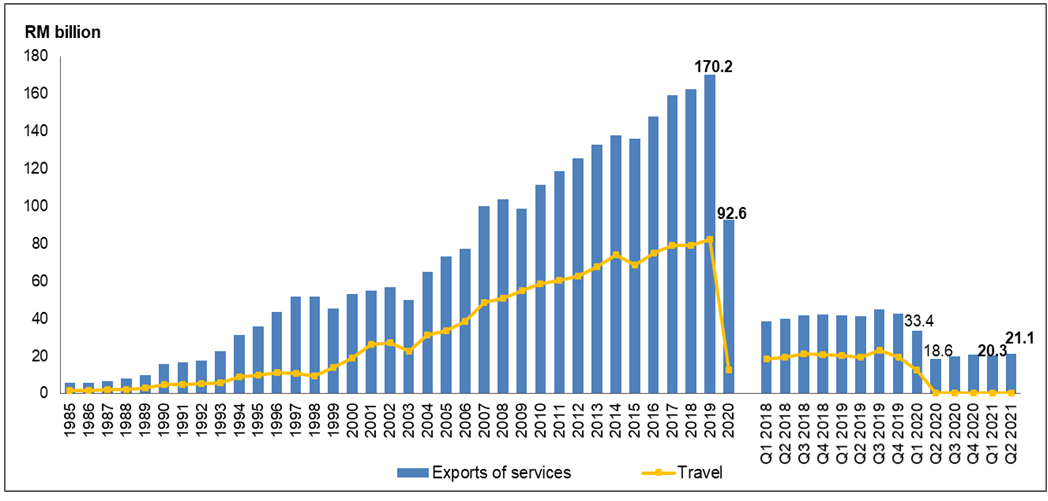

Looking into the performance of services trade, imports recorded RM36.5 billion relatively higher than the value of exports at RM21.1 billion in the second quarter of 2021. This has resulted in a wider Services deficit of RM15.4 billion as against RM15.0 billion in the previous quarter, mainly led by Travel and Transport. As the prolonged unprecedented phenomenon further worsened with a sudden spike in the number of COVID-19 cases starting from mid-May of this year, Malaysia’s borders remain closed for international tourist arrivals. Such scenario had pulled down Travel to log a higher deficit of RM3.6 billion in the current quarter. Similarly, the deficit in Transport also increased by 6.4 per cent quarter-on-quarter to record RM8.1 billion, primarily owing to the higher payments on freight activities which were in line with the increase in imports of goods. Meanwhile, exports of air passenger continued to record a lower receipts since the second quarter of 2020.

However, with the adoption of technology-driven work practices in the new normal brought by the pandemic, ICT related-services indicated better performance especially in Telecommunication, computer and information such as activities of streaming and short-videos sharing through social networking services. Moreover, Personal, cultural and recreational services recorded a higher receipts in this quarter as the e-sports becoming more popular among the youngsters recently, coupled with the continuous initiatives and encouragement from the government.

Meanwhile, the Primary income account recorded a deficit of RM9.5 billion as compared to RM5.7 billion in the first quarter of 2021. It showed that foreign companies in Malaysia earned higher income of RM28.7 billion for this quarter, particularly from Direct investment in Manufacturing and Financial sectors. Concurrently, Malaysian companies abroad also registered a higher income of RM19.3 billion, contributed by significant increase in Portfolio investment.

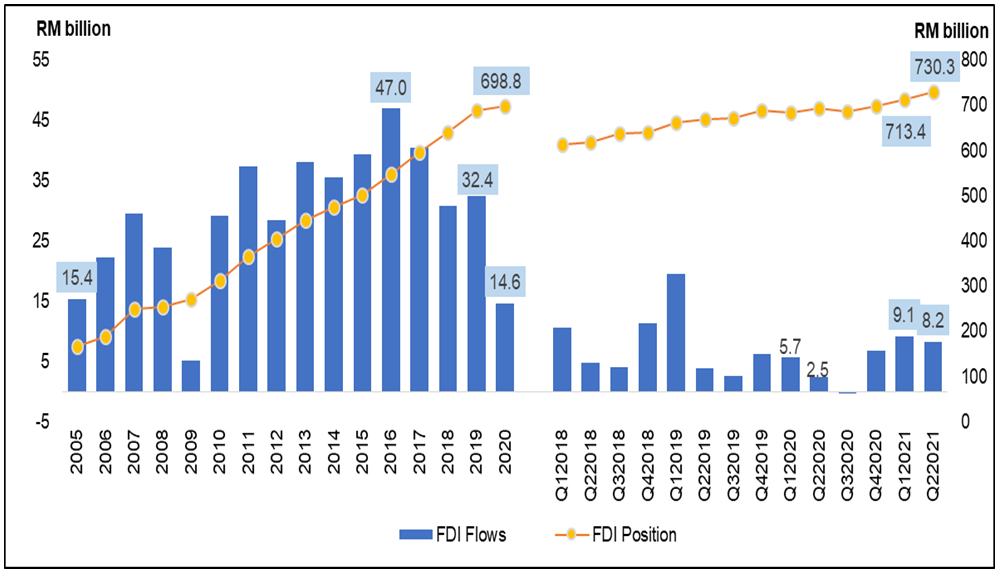

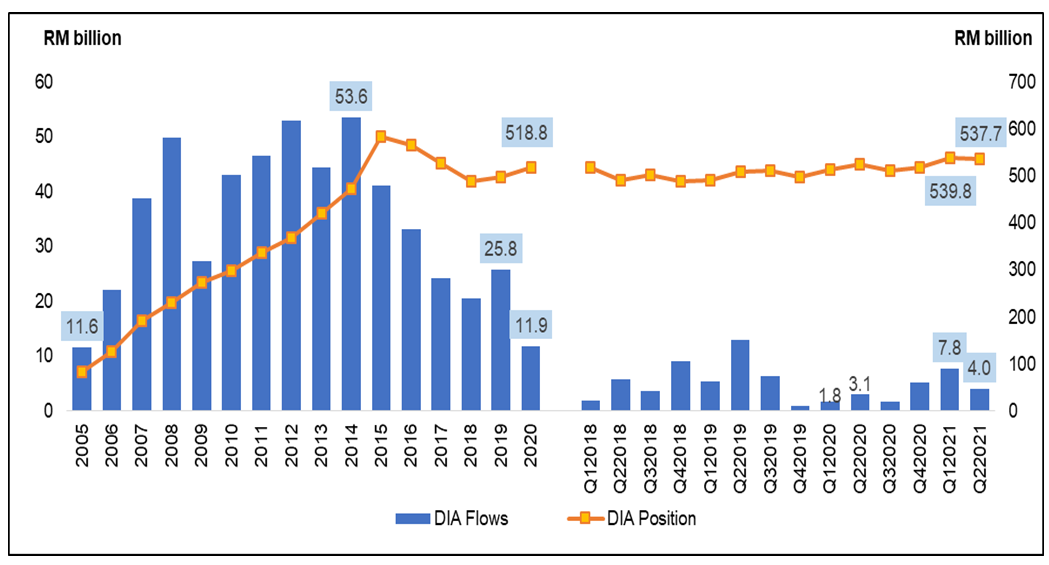

Financial account turned around to register a net outflow of RM7.0 billion in this quarter, from a net inflow of RM16.0 billion in the previous quarter. This was due to Other investment which posted an outflow of RM30.5 billion, mainly led by higher interbank repayments abroad. Meanwhile, Foreign Direct Investment (FDI) registered an inflow of RM8.2 billion for this quarter, principally in the form of equity and investment fund shares. Manufacturing remained as the main sector for foreign investment in Malaysia, followed by Financial and Mining; particularly from Japan, Indonesia and the United States of America. Concurrently, Direct Investment Abroad (DIA) registered an outflow of RM4.0 billion contributed by equity and investment fund shares. Malaysian companies in overseas were mostly engaged in Financial, Manufacturing and Information sectors while the top destinations were the United Kingdom, Indonesia and Canada.

As at the end of second quarter of 2021, FDI position increased RM16.9 billion to register RM730.3 billion, while DIA position was RM537.7 billion. Malaysia’s International Investment Position (IIP) registered a higher net asset of RM112.6 billion as compared to RM106.4 billion in the previous quarter. The international reserves edged up to RM461.5 billion from RM450.8 billion at the end of first quarter of 2021.

The full publication of Quarterly Balance of Payments, Second Quarter 2021 can be downloaded through eStatistik portal.

Chart 1: Current Account Balance, 1985-2020 and Q1 2018 - Q2 2021

Chart 2: Exports of Services,1985-2020, Q1 2018 - Q2 2021

Chart 3: Foreign Direct Investment (FDI) in Malaysia Flows and Position,

Chart 4: Direct Investment Abroad (DIA) Flows and Position,

2005 – 2020 and Q1 2018 – Q2 2021

Chart 5: International Reserve Assets 2005 - 2020 and Q1 2018 – Q2 2021

.png)

Download: Summary Table of Balance of Payments, Q2 2021 ![]() Quarterly Bulletin FDI and DIA, Q2 2021

Quarterly Bulletin FDI and DIA, Q2 2021 ![]()

Released By:

DATO' SRI DR. MOHD UZIR MAHIDIN

CHIEF STATISTICIAN MALAYSIA

DEPARTMENT OF STATISTICS, MALAYSIA

![]() DrUzir_Mahidin

DrUzir_Mahidin ![]()

![]() Dr_Uzir

Dr_Uzir

13 August 2021

Contact person:

Mohd Yusrizal Ab Razak

Public Relation Officer

Strategic Communication and International Division

Department of Statistics, Malaysia

Tel : +603-8885 7942

Fax : +603-8888 9248

E-mail : yusrizal.razak[at]dosm.gov.my

Subscribe

Newsletter

Subscribe to our newsletter and stay updated

For interviews, press statement and clarification to the media, contact:

Baharudin Mohamad

Public Relation Officer

Email: baharudin[at]dosm.gov.my

Phone: 03 8090 4681

Not found what you looking for? Request data from us, through

Go to eStatistik

Email: data[at]dosm.gov.my

Phone: 03 8885 7128 (data request)