Balance of Payments

- Home

- Statistics

- Economy

- External Sector

- Balance of Payments

Quarterly Balance of Payments, Fourth Quarter 2020

Quarterly Balance of Payments, Third Quarter 2020 14 August 2020

Quarterly Balance of Payments, Second Quarter 2020 13 May 2020

Quarterly Balance of Payments, First Quarter 2020 12 February 2020

Quarterly Balance of Payments, Fourth Quarter 2019 15 November 2019

Quarterly Balance of Payments, Third Quarter 2019 16 August 2019

Quarterly Balance of Payments, Second Quarter 2019 Show all release archives

Overview

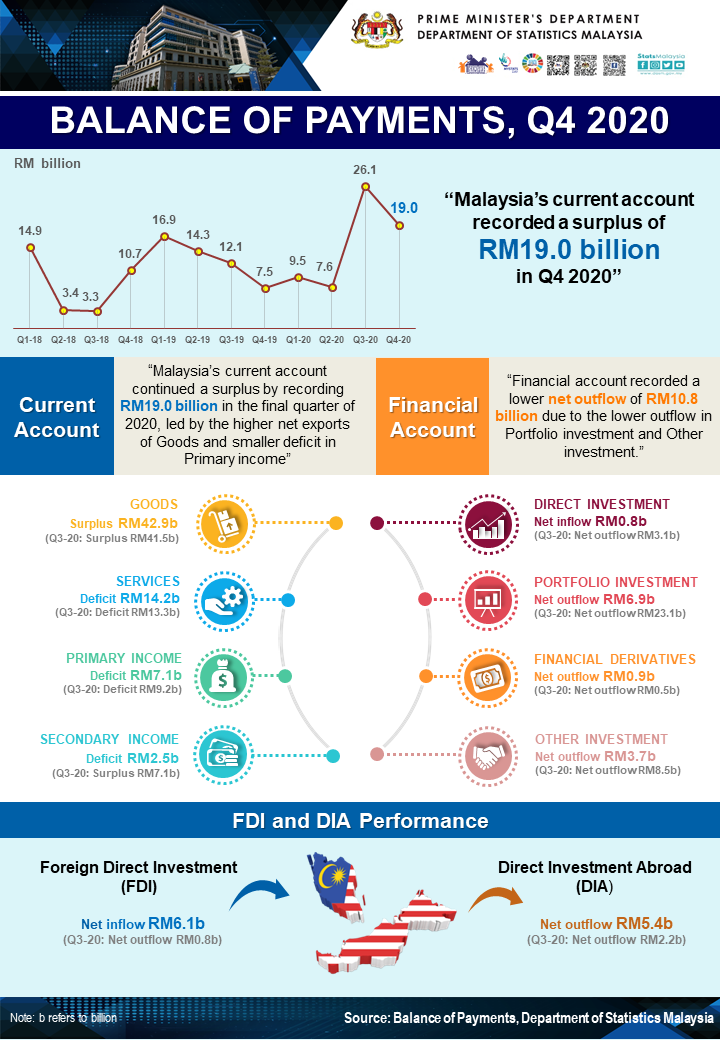

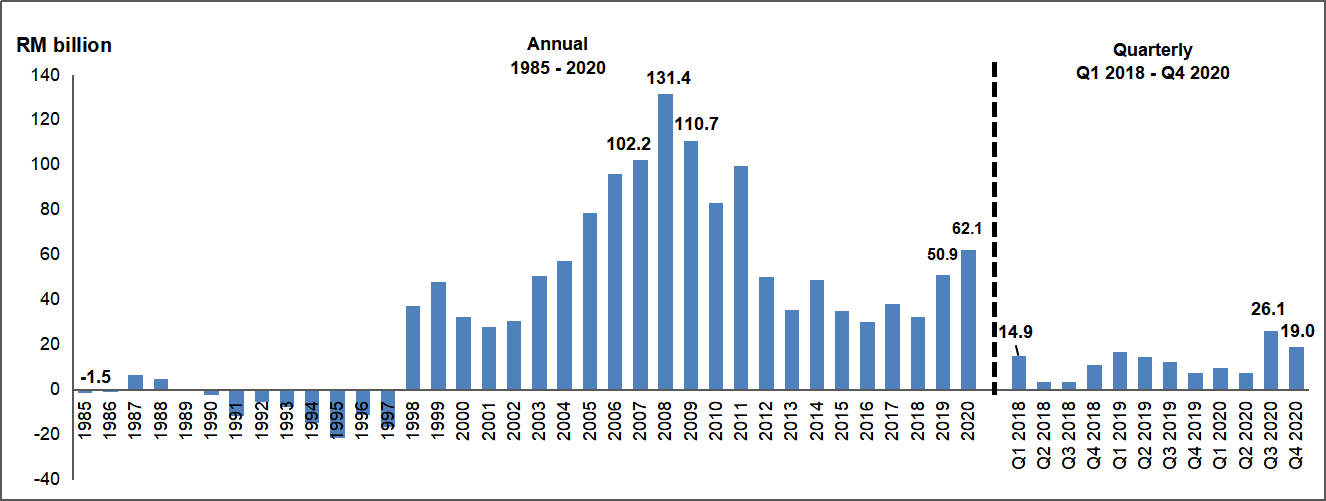

Malaysia posted the highest current account surplus after nine years

The current account surplus in this quarter was led by higher net exports of goods at RM42.9 billion. Exports of goods which contributed 91.4 per cent to overall Malaysia’s exports recorded RM217.5 billion from RM204.9 billion in the previous quarter. The increase was supported by exports of Palm oil, Rubber and Chemicals based products; primarily to China, Singapore and USA. Similarly, imports of goods surged by 6.9 per cent quarter-on-quarter to record RM174.6 billion. The higher imports contributed by the increase in intermediate, capital and consumption goods mainly from China, Singapore and Japan.

The current account surplus in the final quarter was also driven by the lower deficit in Primary income. The net deficit of Primary income narrowed to RM7.1 billion as compared to RM9.2 billion in third quarter of 2020. Malaysian companies abroad earned higher income of RM14.6 billion, an increase of 28.5 per cent from the preceding quarter. Companies located in Indonesia, Singapore and USA were the major contributors and mainly in Financial, Manufacturing and Information & communication sectors. Meanwhile, foreign companies in Malaysia also earned higher income of RM21.7 billion and mainly from Manufacturing and Financial sectors.

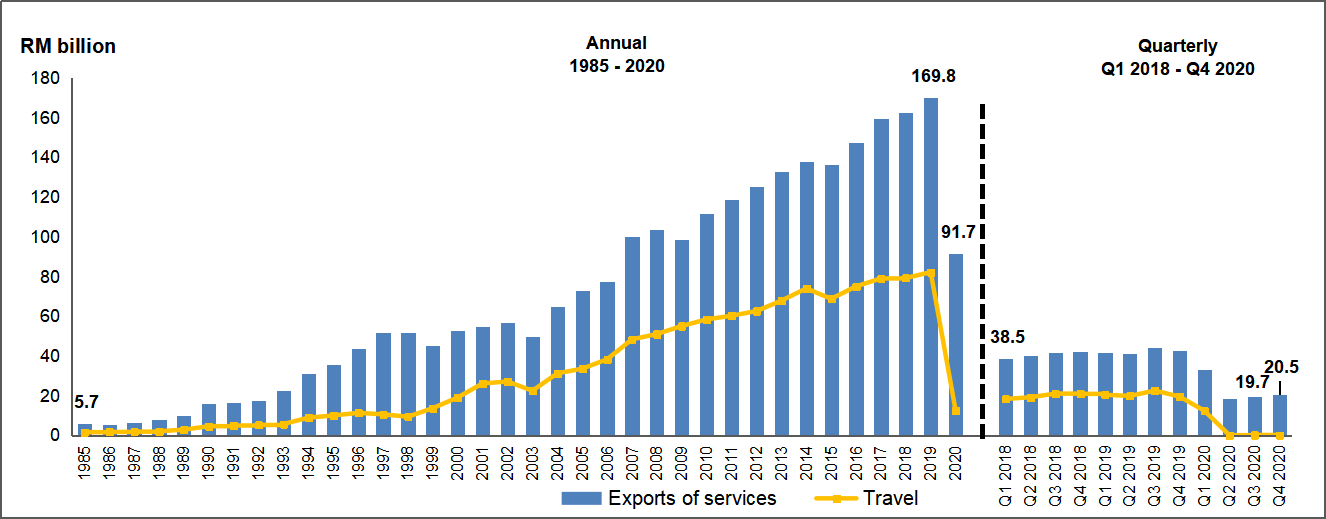

Nonetheless, Services logged a higher deficit of RM14.2 billion as compared to earlier quarters in 2020 due to Transport, Construction and Travel. Both exports and imports of Services increased by RM0.7 billion and RM1.7 billion to record RM20.5 billion and RM34.7 billion respectively.

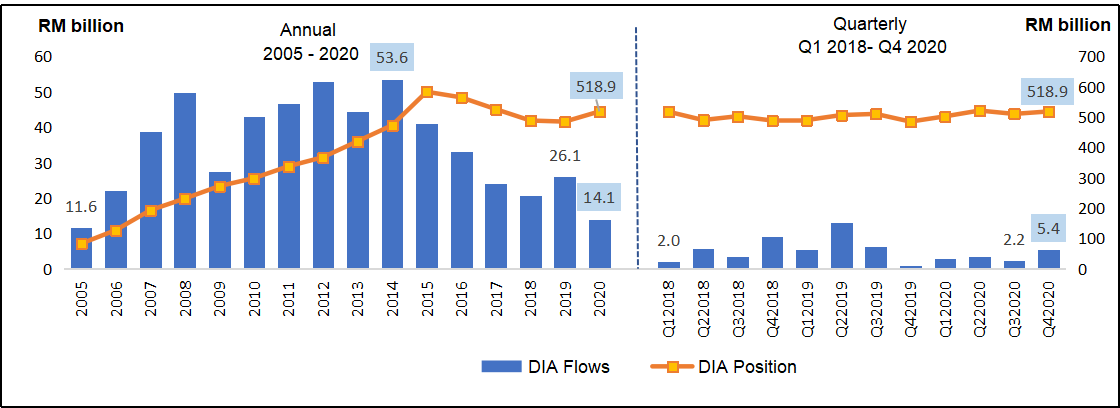

Financial account in this quarter recorded a lower net outflow of RM10.8 billion as against RM35.2 billion last quarter due to the lower outflow in Portfolio investment and Other investment. Foreign Direct Investment (FDI) turned around an inflow of RM6.1 billion from an outflow of RM0.8 billion in the preceding quarter due to higher injection of equity and debt instruments. The FDI inflow was primarily channelled into Manufacturing, Financial and Wholesale & retail trade; particularly from Thailand, Japan and Singapore. Meanwhile, Direct Investment Abroad (DIA) by Malaysian investors registered a net outflow of RM5.4 billion as against RM2.2 billion in the preceding quarter. This was due to higher equity investment abroad and retained earnings in this quarter. Financial, Information & communication and Manufacturing were the major sectors for DIA while the main destinations were Indonesia, Canada and Singapore.

Amid the COVID-19 crisis in 2020, Malaysia has managed to log an encouraging current account surplus which largely supported by net exports of goods at RM139.1 billion. The exports of goods recorded RM778.2 billion mainly in Electrical & electronic, Rubber and Palm oil-based products. Meanwhile, imports of goods posted RM639.1 billion primarily in Electrical & electronic products. The main destinations for both exports and imports were China, Singapore and USA.

Services registered a deficit of RM48.0 billion in 2020, the highest deficit ever recorded. This was the repercussion of border closure and travel restrictions in response to contain the COVID-19 virus, thus Travel being the key component of Services was hit severely. The Tourism related activities in Malaysia are still grappling to find ways to sustain their businesses since number of international tourists has nosedived. As such, Travel logged a deficit of RM7.8 billion for the first time in thirty years.

Transport, the second largest contributor in Services recorded a higher deficit of RM27.5 billion compared to RM25.9 billion in 2019. Exports of transports accounted for RM13.4 billion, a decrease of RM8.2 billion from the previous year due to the decline in air passengers. In line with the decrease in tourist arrivals, exports of air passenger declined to RM1.6 billion in 2020 from RM9.8 billion in the preceding year. Meanwhile, lower payments were recorded for freight activities in transport conforming to the decline in imports of goods. Nevertheless, during this pandemic, the rising demand for online shopping and businesses have led to the increase in exports of courier services under Transport. Apart from that, the new norm of working from home and higher subscriptions of online movies via streaming has increased the imports of Telecommunication, computer and information services.

In terms of income, the Primary income recorded a lower deficit of RM26.2 billion as compared to RM40.3 billion in 2019. Simultaneously, Secondary income account also recorded a lower deficit of RM2.8 billion as against RM21.3 billion in the previous year due to lower outward remittances.

On the Financial front, this account marked a higher outflow of RM79.1 billion in 2020 as against RM33.8 billion a year ago. This owing to higher outflows in Portfolio assets and Other investment. FDI showed a net inflow of RM13.9 billion as against RM31.7 billion. Although, the FDI flow decreased, the FDI position surged by RM14.4 billion to record RM703.5 billion in 2020. Meanwhile, DIA recorded a net outflow of RM14.1 billion as compared to RM26.1 billion in the previous year.

Malaysia’s International Investment Position (IIP) recorded net assets position of RM79.6 billion. The international reserves stood at RM432.2 billion as compared to RM424.0 billion in the preceding year.

The full publication of Quarterly Balance of Payments, Fourth Quarter 2020 can be downloaded through eStatistik portal.

Chart 1: Current Account Balance, 1985-2020 and Q1 2018 - Q4 2020

Chart 2: Exports of Services, 1985-2020, Q1 2018 - Q4 2020

Chart 3: Foreign Direct Investment (FDI) in Malaysia Flows and Position,

2005 – 2020 and Q1 2018 – Q4 2020

Chart 4: Direct Investment Abroad (DIA) Flows and Position,

2005 – 2020 and Q1 2018 – Q4 2020

Download: Summary Table of Balance of Payments, Q4 2020 ![]() Quarterly Bulletin FDI and DIA, Q4 2020

Quarterly Bulletin FDI and DIA, Q4 2020 ![]()

Released By:

DATO' SRI DR. MOHD UZIR MAHIDIN

CHIEF STATISTICIAN MALAYSIA

DEPARTMENT OF STATISTICS, MALAYSIA

![]() DrUzir_Mahidin

DrUzir_Mahidin ![]()

![]() Dr_Uzir

Dr_Uzir

11 February 2021

Contact person:

Mohd Yusrizal Ab Razak

Public Relation Officer

Strategic Communication and International Division

Department of Statistics, Malaysia

Tel : +603-8885 7942

Fax : +603-8888 9248

E-mail : yusrizal.razak[at]dosm.gov.my

Subscribe

Newsletter

Subscribe to our newsletter and stay updated

For interviews, press statement and clarification to the media, contact:

Baharudin Mohamad

Public Relation Officer

Email: baharudin[at]dosm.gov.my

Phone: 03 8090 4681

Not found what you looking for? Request data from us, through

Go to eStatistik

Email: data[at]dosm.gov.my

Phone: 03 8885 7128 (data request)