Business Tendency

- Home

- Statistics

- Economy

- Economics Indicator

- Business Tendency

Business Tendency Statistics, Third Quarter 2025

Business Tendency Statistics, Second Quarter 2025 27 February 2025

Business Tendency Statistics, First Quarter 2025 26 November 2024

Business Tendency Statistics, Fourth Quarter 2024 27 August 2024

Business Tendency Statistics, Third Quarter 2024 30 May 2024

Business Tendency Statistics, Second Quarter 2024 27 February 2024

Business Tendency Statistics, First Quarter 2024 Show all release archives

Overview

FORECAST OF BUSINESS PERFORMANCE FOR THE THIRD QUARTER 2025

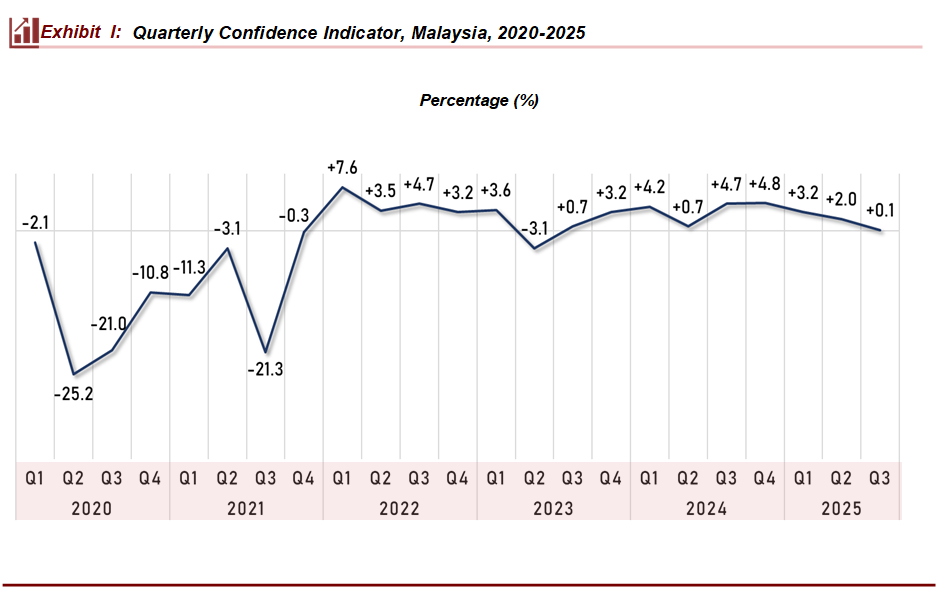

Businesses anticipate a moderation in the business environment in the third quarter of 2025, supported by a positive confidence indicator of +0.1 per cent, which reflects prevailing optimism from the previous quarter’s +2.0 per cent (Exhibit I).

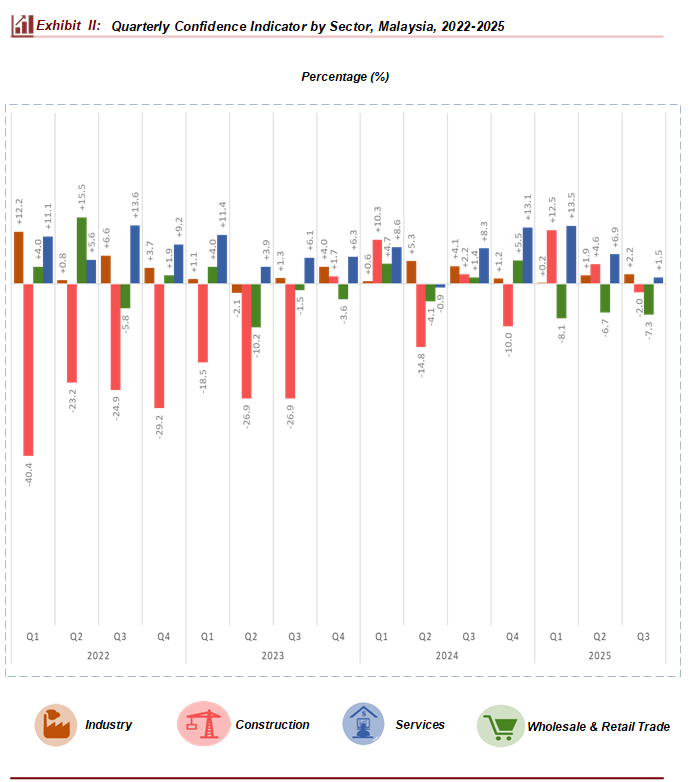

Among all the surveyed sectors, Services remains optimistic in the third quarter of 2025, recording a confidence indicator of +1.5 per cent compared to +6.9 per cent in the previous quarter, showing steady confidence despite the moderation. Construction sector records a confidence indicator of -2.0 per cent in the third quarter of 2025, compared to +4.6 per cent in the preceding quarter, indicating a shift to a more cautious outlook. Meanwhile, Industry sector continues to show steady optimism with a slight increase in confidence to +2.2 per cent from +1.9 per cent in the second quarter of 2025. Turning to Wholesale and Retail Trade sector, the confidence indicator posts -7.3 per cent in the third quarter of 2025, marginally lower than -6.7 per cent in the second quarter of 2025, reflecting persisting caution in the sector. Nevertheless, Retail Trade subsector’s confidence indicator rebounds to a positive trajectory, recording +1.9 per cent compared to ?8.4 per cent previously (Exhibit II).

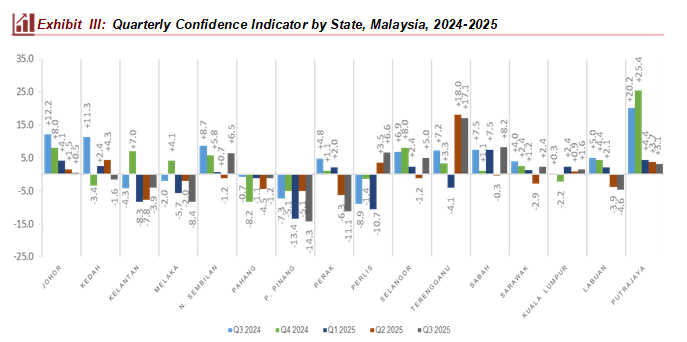

In the third quarter of 2025, state-level business confidence indicators highlight encouraging resilience, with several states showing notable improvements despite others adapt to short-term challenges. Optimistic sentiment was seen in Johor (+0.5%), Negeri Sembilan (+6.5%), Perlis (+6.6%), Selangor (+5.0%), Terengganu (+17.1%), Sabah (+8.2%), Sarawak (+2.4%), W.P. Kuala Lumpur (+1.6%) and W.P. Putrajaya (+3.1%). Meanwhile, Kedah (-1.6%), Kelantan (-3.9%), Melaka (-8.4%), Pahang (-1.2%), Penang (-14.3%), Perak (-11.1%) and Labuan (-4.6%) posted negative readings, underscoring rising pressures in their business climate as illustrated in Exhibit III.

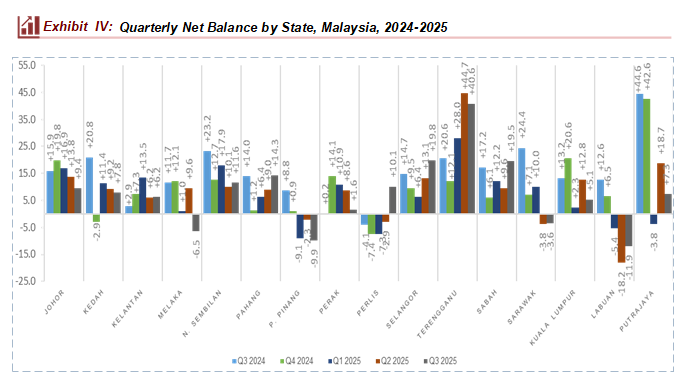

In the third quarter of 2025, net balance by state reflect a broadly optimistic outlook, but with signs of softening in certain states. Strong optimism was recorded in Johor (+9.4%), Kedah (+7.8%), Kelantan (+6.2%), Negeri Sembilan (+11.6%), Pahang (+14.3%), Perak (+1.6%), Perlis (+10.1%), Selangor (+19.8%), Terengganu (+40.6%), Sabah (+19.5%) and W.P. Kuala Lumpur (+5.1%). In contrast, Melaka (-6.5%), Penang (-9.9%), Sarawak (-3.6%), W.P. Labuan (-11.9%) and W.P. Putrajaya (+7.3%) showed weaker or negative readings as illustrated in Exhibit IV.

EXPECTATIONS OF GROSS REVENUE AND NUMBER OF EMPLOYEES

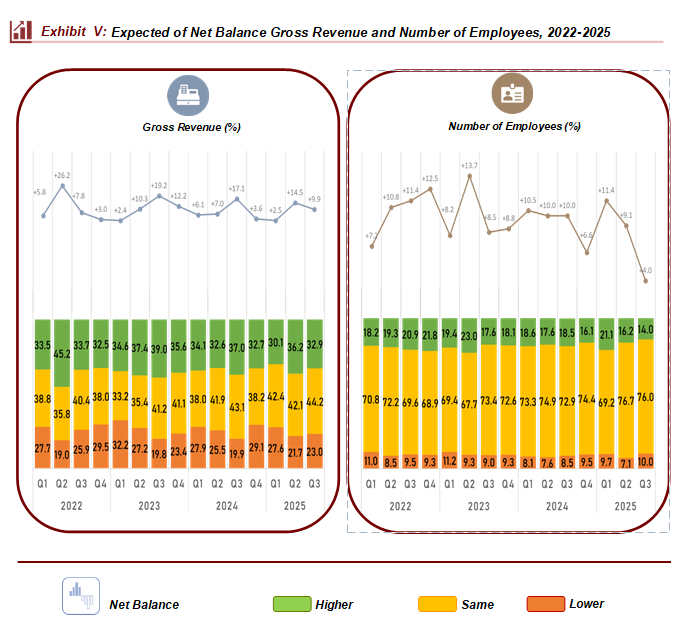

A total of 32.9 per cent of respondents expect their gross revenue to rise in the third quarter of 2025, while 23.0 per cent expect it to drop, resulting in a net balance of +9.9 per cent. Also, 44.2 per cent of respondents predict a standstill in their gross revenue.

In terms of employment, 76.0 per cent of businesses are expecting to retain their staff throughout the thirdquarter of 2025. Approximately 14.0 per cent of respondents anticipate to hire more, while 10.0 per cent expect to reduce their personnel, resulting in a net balance of +4.0 per cent for the reference quarter (Exhibit V).

EXPECTATIONS OF BUSINESS PERFORMANCE IN JULY TO DECEMBER 2025

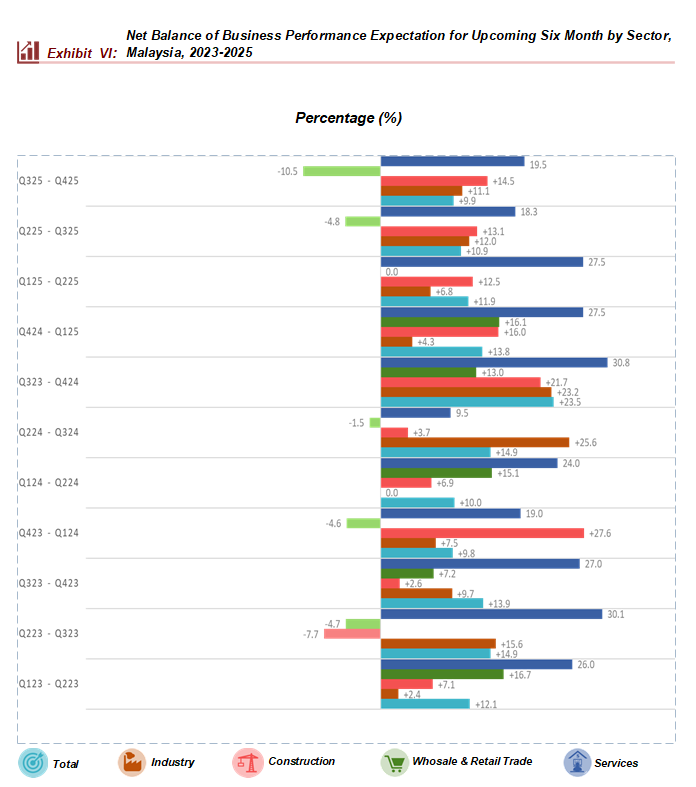

Looking ahead to the July until December 2025 period, the overall business outlook remains positive, posting a net balance of +9.9 per cent compared to +10.9 per cent in the previous half-year. Services sector shows steady resilience, improving marginally to a net balance of +19.5 per cent from +18.3 per cent. Construction sector’s outlook brightens, with the net balance at +14.5 per cent as against +13.1 per cent. Similarly, Industry sector projects a favourable business environment, with the net balance at +11.1 per cent compared to +12.0 per cent in the preceding period. Meanwhile, Wholesale and Retail Trade sector records a net balance of -10.5 per cent from -4.8 per cent in the previous period (Exhibit VI).

Data

Press Statement

Technical Notes / Methodology

Subscribe

Newsletter

Subscribe to our newsletter and stay updated

For interviews, press statement and clarification to the media, contact:

Baharudin Mohamad

Public Relation Officer

Email: baharudin[at]dosm.gov.my

Phone: 03 8090 4681

Not found what you looking for? Request data from us, through

Go to eStatistik

Email: data[at]dosm.gov.my

Phone: 03 8885 7128 (data request)